December 3, 2025

On Pointe Podcast: Helping Family Offices Make Smart Aviation Decisions

Read More

Should you pay cash or lease or finance your next aircraft? It’s a great question and one that we often answer for our clients here at Guardian Jet.

Below we’ll compare the different options for aircraft financing in an effort to help you understand its impact on your fleet plan.

But first, let’s see what the industry is doing, domestically here in the U.S., and abroad.

Cash is king.

At least when it comes to buying a new aircraft in the U.S., according to Michael Chase, principal at Chase & Associates.

In his report, nearly three-quarters (73%) of new aircraft owners purchase their planes outright. And this is a statistic that’s remained largely constant since 2006.

But, internationally, things are different when it comes to aircraft finance.

When JETNET iQ’s Quarterly report surveyed 500 aircraft operators globally, only about 45% shared that that they prefer cash—or cash followed by financing—as their preference.

Where international buyers are concerned, financing is more popular.

Yet leasing is gaining considerable traction, thanks to record demand and strong liquidity. It’s an aircraft financing option that creates more efficient risk management of aircraft residual values.

In Boeing’s 2018 Current Aircraft Finance Market Outlook, aircraft leasing continues to grow in absolute size while maintaining a 40% global market share.

So, what is your best option when it comes to aircraft finance?

How do you factor in aircraft residual values? And should you let someone else take on the risk while you use your cash to fund other projects or assets?

Let’s get down to it and discuss the pros and cons of the different purchasing vehicles. Then we’ll go into an actual example of buying or leasing a $10M airplane.

In an aircraft lease, the pros are as follows:

The cons of an aircraft lease:

The pros of financing an aircraft:

The cons of financing an aircraft:

The pros of purchasing an aircraft with cash:

You get great tax benefitsfrom owning your own airplane. You will save money over time. Cash is the less expensive option over the life cycle of your ownership from a life cycle cost perspective. You have the most flexibility when you sell. If your corporate travel mission changes, you can sell more quickly without lease penalties, and there’s no loan to pay off. You have no transaction costs. You have no restrictions. This enables you to use the aircraft as you wish, and choose whether to add an engine program (it’s not required). Excessive wear and tear is not an issue (at least to the lessor).

The cons of purchasing an aircraft with cash:

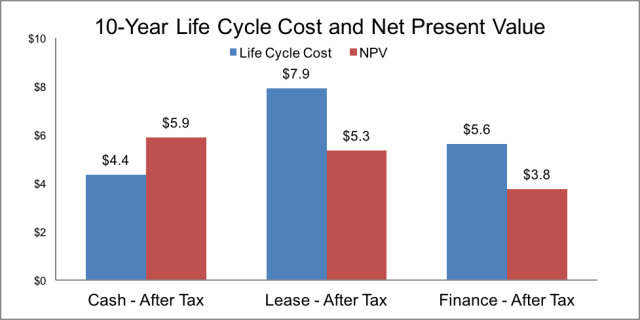

In the following case study, we looked at financing options for a nearly new aircraft that’s less than three years old and has fewer than 1,000 hours. The purchase price is $10M, and we outlined both the 10-year life cycle cost and the net present value.

Our assumptions for a 10-year cash flow example:

Ok. Now, let’s get into the specifics. Looking at the chart above, the blue lines represent the life cycle costs of owning the airplane over 10 years.

In the first column, the cash purchase has a very low life cycle cost.

But when you apply the cost of money or the net present value (NPV), it’s very high. In fact, it’s much higher than the life cycle cost because in the beginning of that term, you paid $10M.

Life cycle cost explained:

You buy the airplane and pay for it, including all the operating costs. You get the tax benefits, if any, and then you sell the airplane. Or, in the case of the lease, terminate the lease at the end. And then you look at your total costs.

Net present value explained:

The value of a sum of money in today’s market, in contrast to some future value it will have when it has been invested at compound interest.

In an aircraft lease, you’ll have high life cycle operating costs because you’re paying a lot of money over time to lease this airplane.

But, unlike in the purchase, because you’re paying it over time (and it becomes a discount rate), you actually have a lower NPV than your life cycle costs.

It’s much less expensive to pay with cash than to lease, but you can see the difference, and remember that there are some advantages to leasing.

In the third column, you’ll see that financing the airplane clearly comes out ahead from a net present value perspective. This is due to the lower capital outlay combined with the ability to reap the benefits of the 100% bonus depreciation.

With all of that said, every aircraft ownership decision is unique to the corporate or high-net-worth individual.

We’re always more than happy to discuss your particular needs. To learn more, visit our financial projections page or give us a call at 1-203-453-0800. We’d love to help you out.

Contact Guardian JetLearn the latest about aircraft sales, brokerage trends and more.

By submitting your information, you acknowledge that you may be sent marketing material and newsletters.

Your information is secure and will never be shared with any third party. View our Privacy Policy