December 3, 2025

On Pointe Podcast: Helping Family Offices Make Smart Aviation Decisions

Read More

Don Dwyer, managing partner of Guardian Jet, talks to Anthony Harrington from Business Aviation Magazine. They spoke about building a leading position as advisor, broker and consultant to Fortune 500 companies on all things related to private jets.

Anthony Harrington: How did it all begin?

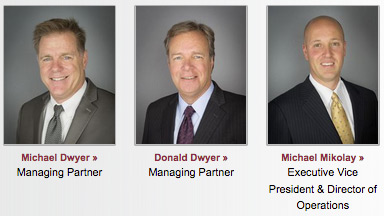

Don Dwyer: Guardian Jet, one of the big three aircraft brokers, was founded in 2002, some 16 years ago, by my brother, Mike Dwyer, along with Mike Mikolay.

My brother, Mike, and I share managing partner responsibilities and Mikolay is our Executive Vice President, responsible for operations.

AH: Having two brothers as joint managing partners is something of a unique set up for this industry. How do you two manage to keep the peace between you and avoid sibling rows?

DD: (Laughs) In the beginning of our careers, out of necessity because we had a tiny budget, we made do with a very small office with our desks butting up against each other.

Now we have a very nice, architect-designed office. We still have our desks in the same room, not because we have to, but because it’s still the best way for us both to stay in touch with everything that is happening and what the other one is doing.

He’s better at some things than I am, so we each play to our strengths and we get along splendidly!

AH: So, how did the business fare in the early days?

DD: We took a very different approach to most start-ups. A lot of small businesses start regionally and slowly extend their customer base to other states.

We, on the other hand, started off as a customer-centric business. And, right from the outset, we said we wanted to serve the needs of the most sophisticated and demanding customer base in the world, namely the directors and senior executives of Fortune 500 companies.

We told ourselves that we wanted to earn the right to advise and to represent these companies across a range of transactions. We are a consultancy, first and foremost, and Fortune 500 companies have embraced our approach.

AH: How would you characterise the work of a great consultancy when it comes to buying and selling jets?

DD: If you’re behaving in your customer’s best interests, you should find that as often as you are saying, "Now is a great time for you to buy," you should also find yourself saying, almost as many times, "Let’s slow down and hold on to the aircraft that we currently have!"

This last bit of advice is not going to make you money, but it’s going to build your reputation for independence and for putting the client’s interests first—and that is what we’re focused on.

And ultimately, of course, the quality of your reputation is what brings in new clients and retains the client base.

We’ve had customers we’ve given that advice to turn around and say, "Hey, aren’t you a broker? Aren’t you supposed to be selling us the jet?" And the answer is, "Not if it’s not in your best interests right now!"

AH: You are strong in the Fortune 500 segment of the market, what about the high net worth side?

DD: If you look at the number of deals we’ve done over time, we have a very high concentration of Fortune 500 clients represented in those deals.

But we love the HNWI business and we’re growing a sales force specifically to focus on individuals who have the means to own private jets.

There tends to be a different feel to the two kinds of transactions. Fortune 500 companies want a defensible plan when they allocate capital to buy a jet. They want to be able to show its value to the business.

With a high-net-worth person, you’re really looking to see that they’ll be comfortable with the purchase and the ongoing costs.

It is important to make the point that we are not an operational consultancy. We don’t set out to tell clients how to fly more safely or more economically. Our consultancy is all about the capital that you’re going to invest in your aircraft.

We analyse all the scenarios that apply to a possible purchase, including what it would cost to charter for the equivalent number of flight hours a year.

We show them what it will cost to operate that particular aircraft and what the residual value is likely to be, and we will help them by providing all the facts around the decision.

But we don’t try to talk the client into buying the aircraft. That is their decision and we only put it to them when we are comfortable with it.

AH: Are you seeing any real change in the market today versus a few years ago?

DD: Right now, we’re seeing a host of first time buyers. It seems to me that at long last we are seeing a real charge from the fractional jet side of the market.

We’ve been waiting forever, it seems, for the first wave of buyers to come out of the fractional market and acquire their own aircraft. It is really starting to happen at last.

AH: What about the financing side of the business? Is there the cash available from the market to support the acquisition of new and pre-owned jets?

DD: We can always find a finance company for a qualified buyer. However, we live in the world of qualified buyers. Trying to get financing for unqualified buyers is very difficult and you should probably not be doing that.

For a high-end broker, such as ourselves, there are more than enough customers that fall into the "qualified" category and who really are in the market to buy a jet.

AH: What about residuals? Th is can be a very elusive number to try to pin down, can it not?

DD: We have as much data on residual values as anyone on the planet. However, the bottom line for any owner is that a jet is a depreciating asset, with some models depreciating faster than others.

A Phenom 300, for example, holds its value very well. Today it has the same year on year residual value as pretty much all models used to have pre-2007. You also know that the Gulfstream G650 is going to hold its value better than most.

AH: I take it you are buying and selling both new and pre-owned?

DD: We buy an awful lot of new aircraft because of the nature of our client base. But we always look at the relative values and merits of new and pre-owned.

With our Fortune 500 clients, what we do is to try to help them to get some logical cadence into their buying. If they hold on to a jet for too long, for example, the delta between what their aircraft is worth and the new price will be huge.

If you buy more regularly, that delta becomes much more manageable. | BAM

To view the original Spring 2018 article online in Business Aviation Magazine, visit Bizav Media Ltd’s flipbook.

Contact Guardian JetLearn the latest about aircraft sales, brokerage trends and more.

By submitting your information, you acknowledge that you may be sent marketing material and newsletters.

Your information is secure and will never be shared with any third party. View our Privacy Policy