December 3, 2025

On Pointe Podcast: Helping Family Offices Make Smart Aviation Decisions

Read More

"How long should I own my airplane" and "When should I replace my airplane?" These are two questions we’re asked quite often here at Guardian Jet.

These are great questions, and unfortunately, there’s no perfect answer. In fact, if we asked 10 directors of aviation, chief pilots or aircraft owners, we might get 10 different answers.

While there’s no industry standard of how long you should own an airplane, we find that the ideal ownership life cycle is between 5 and 15 years.

To give you a more definitive answer, we did the math. And what we found might surprise you. The short answer is that there’s really no bad answer—at least from a capital point of view.

To explain further, we ran a cash flow financial projection to operate a Bombardier Global 6000.

In a cash flow scenario, you buy or trade in an airplane and include all of the operating expenses. These annual costs include: capital equipment, operating budget, tax benefits, salaries, etc.

Then when we go to sell the airplane, we’re able to recover the residual value into the cash flow. (Taking into consideration the aircraft’s value when you sell it is important in the aircraft purchase decision).

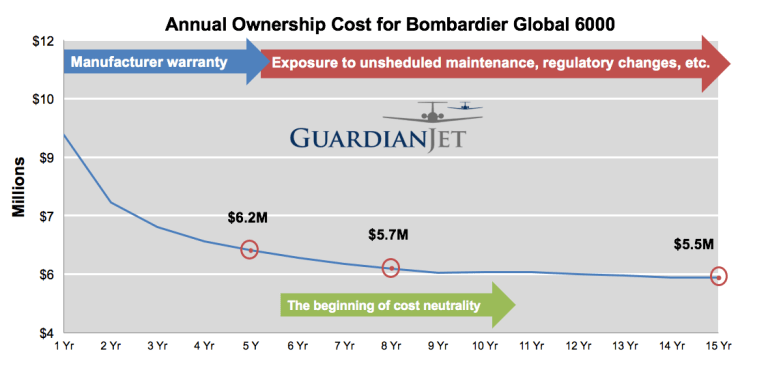

In order to determine the average yearly ownership costs (or life cycle costs), we put together the following graph. (FYI, the math works similarly with new and pre-owned airplanes.)

As you’ll see, we ran the numbers over a 15-year period, and showcase several cash flow scenarios for the purchase of a new Bombardier Global 6000.

How long should I own my airplane? Above is an example of annual ownership costs for a new Bombardier Global 6000 over a 15-year period. Produced by Guardian Jet, LLC.

Annual Operating Expenses

First off, we intuitively know that if we buy an airplane every year, and replaced it every year for 15 years, it would be incredibly expensive. Our average annual ownership costs is just under $9.5M.

Conversely, if we owned the same plane for 15 years, our average annual cost is $5.5M.

The interesting thing is to track what happens when we buy every 2 years, every 3 years, every 4 years, etc. We find that the curve stabilizes about 5 or 6 years of aircraft ownership.

This is the beginning of cost neutrality.

Look for the Bump

Annual operating expenses tend to have a bump in year 10. The reason being that if you want to keep your airplane "sellable," you should pay to refurbish paint and interior every 7 to 8 years. This makes sense if you fly the aircraft an average of 500 hours.

According to our example, you’ll see the curve flattens out after paint and interior and goes down very slowly. This tells us that if you buy every 5 years, your annual operating expense it’s $6.2M. If you buy every 8 years, your annual operating cost is $5.7M. And if you buy every 15 years, the average annual cost is $5.5M. This is about $200,000 a year less than buying one every 6 years.

From a capital point of view, it’s not a bad thing to own it for 15 years. And it’s not a bad thing to own it and replace it at 5 or 6 years.

There are some other things that go into when you should what how often you should replace your airplane. Certainly, there’s increased exposure to unscheduled maintenance and regulatory issues. Let’s look at a few of those considerations:

Regulatory Changes

By the year 2020, aircraft owners are required to meet a slew of new regulatory issues. Thankfully, most of our clients have already taken care of these upgrades).

But many airplane owners are still wondering whether to make an investment in their older airplane. Maybe a significant investment—worth millions—that they won’t get back? They’re wondering if they should go ahead and replace the aircraft with a newer model?

You likely know that with some older airplanes, it just doesn’t make financial sense to upgrade to ADS-B, etc. Owners won’t make their money back. This creates market obsolescence for certain makes and models that are no longer attractive, or competitive in the marketplace.

Residual Values

Another thing we look at, when we talk about residual values, is with an older airplane and airplane that you replace every 14 or 15 years, they tend not to do as well in volatile economies.

We track everything residual values against the Dow. When the Dow recovers, we’ll see the newer airplanes recover very closely to when and how much the economy recovers. But the older airplanes do not recover as well no matter what happens to the economy, and do not regain their value. This is a very good reason for considering moving your purchase decision to the left—or shortening the ownership interval.

Wrap Up

So that’s a short review on how long we think you should own airplanes. Again, from a capital point of view, there’s no bad answer, which is why there’s no industry standard.

Thank you for reading. Please give us a call if you’d like us to run the numbers for your airplane. Here at Guardian Jet, we have a lot of financial projection tools like this that we’d like to share with you.

Contact Guardian JetLearn the latest about aircraft sales, brokerage trends and more.

By submitting your information, you acknowledge that you may be sent marketing material and newsletters.

Your information is secure and will never be shared with any third party. View our Privacy Policy